US benzene hits 18-month high on tight supply

US benzene (BZ) this week reached an 18-month high on tight prompt supply, shipping delays and steady demand.

US BZ increased on Tuesday by 1.5¢/USG to 427.5¢/USG, the highest Argus assessment since 29 July 2022.

A heavy US refinery turnaround season in the current-quarter reduced US Gulf coast refining rates to 80.6pc last week, according to the Energy Information Administration. Refinery maintenance reduces reformer operating rates, yielding less derivative gasoline and aromatics, such as benzene.

Benzene from reformate comprised an estimated 70pc of US benzene production last year — up from 66.5pc in 2022 — so reduced refinery rates have meant even less BZ availability in the snug domestic barge market and more reliance on imports.

But logistics constraints, including low water levels at the Panama Canal and ongoing Red Sea vessel attacks, have delayed BZ import arrivals from Asia.

Transpacific shipping costs for a 40,000 metric tonne (t) midrange vessel have climbed to $120/t, up from $80/t a year ago, as transit times have lengthened from 35 days to 55-60 days. Transatlantic transit shipping costs have nearly doubled over the past year from $32/t to $60/t for a 10,000t cargo.

Higher freight costs and longer transit times have prompted US traders to bid up BZ to attract imports. Additionally, delays in imports arriving have led to some short covering efforts until volume does arrive, further supporting prices.

Benzene inventories ended 2023 at low levels, estimated by Argus at just 16 days of rateable consumption, compared to previous year-end levels above 20 days of consumption.

A revival of C6 exports — including BZ derivatives styrene monomer and cyclohexane — as well as forward demand for blendstocks ethylbenzene and cumene, has also supported a 33pc rebound in BZ prices since 2 January, when BZ started the year assessed at 322¢/USG, according to Argus data.

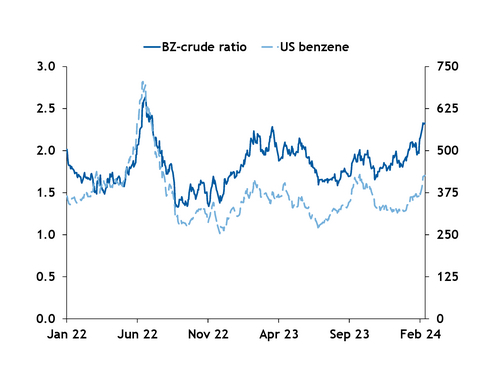

The BZ-to-crude ratio, a metric for valuing derivative US Gulf coast BZ relative to upstream feedstock WTI crude, reached an 18-month high on 12 February at 2.33, when BZ hit 426¢/USG and March WTI crude futures settled at $76.92/bl. The BZ-to-crude ratio has averaged below 1.9 over the past five years. In a balanced US benzene market, spot benzene generally averages 1.95 times the value of front-month WTI futures.

Related news posts

India’s Gail signs 14-year time charter for LNG carrier

India’s Gail signs 14-year time charter for LNG carrier

Mumbai, 17 May (Argus) — India's state-controlled gas distributor Gail has signed a 14-year time charter agreement with US-based LNG shipping firm CoolCo for an LNG carrier, the former said on 16 May. The time charter for the LNG carrier will start operating from early 2025 as it is currently under construction. Gail is likely to receive the carrier during October-December in the Gulf of Mexico, CoolCo said. The charter will be the fifth LNG carrier in Gail's vessels that are intended to secure long-term supply of LNG in India. Gail will have an option to extend the charter by two additional years beyond its contracted 14-year period. The LNG carrier will likely be used to ship LNG volumes from the US, Russia, and from its recent contracts with Abu Dhabi's state-owned Adnoc and trading firm Vitol , a company official told Argus . (See table) "Long-term cargoes are there and there are a few lifts from the spot markets as well," the source added. "It is how the consumption pattern of the country is now shaping more towards LNG since domestic volumes are constrained." The firm also planned to add an LNG tanker to ship cargoes from the US, Argus exclusively reported in February. Gail expects India's gas demand to rise and has been looking to secure more term deals . Gail is seeking an additional 7mn-8mn t/yr of LNG for its portfolio with a further 1mn-2mn t/yr, the firm said in January. This reiterates targets set in August last year . Gail's portfolio growth aligns with the government's plan to increase the share of gas in its primary energy mix to 15pc by 2030 from around 6pc in 2022. By Rituparna Ghosh Gail contracts mn t/yr Supplier/terminal Volume Fob/des Dates Sabine Pass 3.5 fob 2018-38 Cove Point 2.3 fob 2018-38 SEFE 2.5 des 2018-41 Vitol 1.0 des 2026-36 Adnoc 0.5 des 2026-36 Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Texas barge collision shuts GIWW section: Correction

Texas barge collision shuts GIWW section: Correction

Corrects volume of oil carried by barge in fourth paragraph. Houston, 16 May (Argus) — Authorities closed a six-mile section of the Gulf Intracoastal Waterway (GIWW) near Galveston, Texas, because of an oil spill caused by a barge collision with the Pelican Island causeway bridge. The section between mile markers 351.5 and 357.5 along the waterway closed, according to the US Coast Guard. A barge broke away from the Philip George tugboat and hit the bridge between Pelican Island and Galveston around 11am ET today. Concrete from the bridge fell onto the barge and triggered an oil leak. The barge can hold up to 30,000 bl oil, but it was unknown how full the barge was before the crash, Galveston County county judge Mark Henry said. It was unclear when the waterway would reopen. An environmental cleanup crew was on the scene along with the US Coast Guard and Texas Department of Transportation to assess the damage. Multiple state agencies have debated the replacement of the 64-year-old bridge for several years, Henry said. The rail line alongside the bridge collapsed. Marine traffic does not pass under the bridge. By Meghan Yoyotte Intracoastal Waterway at Galveston Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Low-carbon methanol costly EU bunker option

Low-carbon methanol costly EU bunker option

New York, 16 May (Argus) — Ship owners are ordering new vessels equipped with methanol-burning capabilities, largely in response to tightening carbon emissions regulations in Europe. But despite the greenhouse gas (GHG) emissions savings that low-carbon methanol provides, it cannot currently compete on price with grey methanol or conventional marine fuels. Ship owners operate 33 methanol-fueled vessels today and have another 29 on order through the end of the year, according to vessel classification society DNV. All 62 vessels are oil and chemical tankers. DNV expects a total of 281 methanol-fueled vessels by 2028, of which 165 will be container ships, 19 bulk carrier and 14 car carrier vessels. Argus Consulting expects an even bigger build-out, with more than 300 methanol-fueled vessels by 2028. A methanol configured dual-fuel vessel has the option to burn conventional marine fuel or any type of methanol: grey or low-carbon. Grey methanol is made from natural gas or coal. Low-carbon methanol includes biomethanol, made of sustainable biomass, and e-methanol, produced by combining green hydrogen and captured carbon dioxide. The fuel-switching capabilities of the dual-fuel vessels provide ship owners with a natural price hedge. When methanol prices are lower than conventional bunkers the ship owner can burn methanol, and vice versa. Methanol, with its zero-sulphur emissions, is advantageous in emission control areas (ECAs), such as the US and Canadian territorial waters. In ECAs, the marine fuel sulphur content is capped at 0.1pc, and ship owners can burn methanol instead of 0.1pc sulphur maximum marine gasoil (MGO). In the US Gulf coast, the grey methanol discount to MGO was $23/t MGO-equivalent average in the first half of May. The grey methanol discount averaged $162/t MGOe for all of 2023. Starting this year, ship owners travelling within, in and out of European territorial waters are required to pay for 40pc of their CO2 emissions through the EU emissions trading system. Next year, ship owners will be required to pay for 70pc of their CO2 emissions. Separately, ship owners will have to reduce their vessels' lifecycle GHG intensities, starting in 2025 with a 2pc reduction and gradually increasing to 80pc by 2050, from a 2020 baseline. The penalty for exceeding the GHG emission intensity is set by the EU at €2,400/t ($2,596/t) of very low-sulplhur fuel oil equivalent. Even though these regulations apply to EU territorial waters, they affect ship owners travelling between the US and Europe. Despite the lack of sulphur emissions, grey methanol generates CO2. With CO2 marine fuel shipping regulations tightening, ship owners have turned their sights to low-carbon methanol. But US Gulf coast low-carbon methanol was priced at $2,317/t MGOe in the first half of May, nearly triple the outright price of MGO at $785/t. Factoring in the cost of 70pc of CO2 emissions and the GHG intensity penalty, the US Gulf coast MGO would rise to about $857/t. At this MGO level, the US Gulf coast low-carbon methanol would be 2.7 times the price of MGO. By comparison, grey methanol with added CO2 emissions cost would be around $962/t, or 1.1 times the price of MGO. To mitigate the high low-carbon methanol costs, some ship owners have been eyeing long-term agreements with suppliers to lock in product availabilities and cheaper prices available on the spot market. Danish container ship owner Maersk has lead the way, entering in low-carbon methanol production agreements in the US with Proman, Orsted, Carbon Sink, and SunGaas Renewables. These are slated to come on line in 2025-27. Global upcoming low-carbon methanol projects are expected to produce 16mn t by 2027, according to industry trade association the Methanol Institute, up from two years ago when the institute was tracking projects with total capacity of 8mn t by 2027. By Stefka Wechsler Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Japan’s NS United plans methanol-fuelled bulk carriers

Japan’s NS United plans methanol-fuelled bulk carriers

Tokyo, 15 May (Argus) — Japanese shipping company NS United Kaiun plans to order several methanol-fuelled Capesize bulk carriers, targeting to begin delivery from 2027, as its aims to reduce greenhouse gas (GHG) emissions from shipping raw materials for steel production. NS United Kaiun signed an initial agreement on 13 May with Japanese shipbuilders Imabari Shipbuilding and Japan Marine United and domestic vessel engineer Nihon Shipyard to build several methanol-fuelled ships of 209,000dwt each. The vessels will be equipped with dual-fuel engines, which can burn methanol and conventional marine fuel. NS United Kaiun expects the future use of green methanol will cut GHG emissions by more than 80pc compared with conventional marine fuel. The company will also co-operate with fuel developers to buy green methanol. Methanol has emerged as a potential alternative fuel as the marine sector looks to cut its GHGs. Fellow Japanese shipping firm NYK Line also plans to receive six chemical tankers over 2026-29, which will burn very-low sulphur fuel oil but will be designed to convert to use methanol. By Nanami Oki Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Business intelligence reports

Get concise, trustworthy and unbiased analysis of the latest trends and developments in oil and energy markets. These reports are specially created for decision makers who don’t have time to track markets day-by-day, minute-by-minute.

Learn more