Corrects final sentence to say 'Ukrainian exit bookings to Poland', rather than 'Polish exit bookings to Ukraine'

Ukraine may require gas imports through routes other than Slovakia if it is to bring its stocks in line with recent-year averages by the start of winter 2022-23.

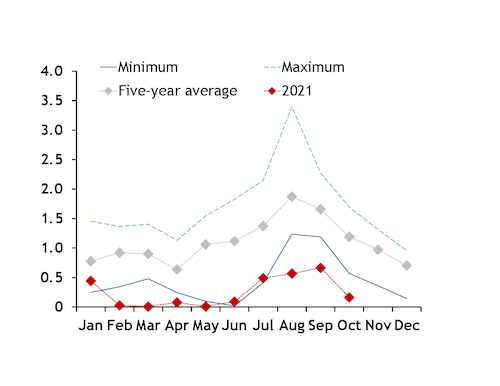

Re-exports to the EU of gas held in Ukrainian storage sites on customs-free terms have ramped up in recent months, while imports have been low (see imports graph). This has pushed storage withdrawals to well above average levels.

The only EU border point at which Ukraine holds firm entry capacity is Budince on the Slovak border, which has a technical capacity of 27mn m³/d. Its imports from Hungary and Poland are available on an interruptible basis and depend on Russian gas transiting the country in the opposite direction. Ukrainian transit to Hungary has been at zero since 1 October after Gazprom redirected flows to Hungary through Turkish Stream, making it more difficult for Ukraine to import from the EU.

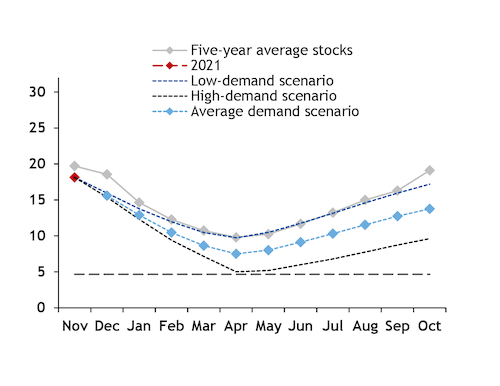

Assuming re-exports to the EU from Ukraine in November are flat to October and then stop for the rest of this winter and the following summer, and Ukraine's imports step up from the start of 2022 and hold consistently at 27mn m³/d — in line with Budince's capacity — until the end of September, stocks will enter the following winter much lower than in recent years unless consumption is at a long-term low.

The three Ukrainian gas demand scenarios outlined below, as well as making the above assumptions for import and re-export patterns, assume that domestic output for the rest of this winter and the following summer holds flat to October.

In a scenario in which domestic consumption is consistently in line with its highest in the past five years for each month in November 2021-September 2022, stocks would be just 9.5bn m³ on 1 October 2022 (see stock scenarios graph). This would be well down from the average for the date of 19.1bn m³ in 2016-21. Stocks were lowest on the date in that six-year period at 14.3bn m³ in 2016.

In the high-demand scenario, just 5.1bn m³ would be left in storage on 1 April. This is only slightly higher than long-term storage reserves of 4.66bn m³.

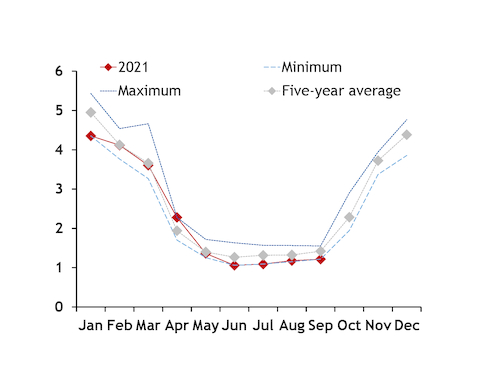

In a low-demand scenario — with consumption in each month at its weakest in five years — start-of-October stocks would be only 1.9bn m³ below the six-year average for the date. But this scenario appears unlikely, as the Ukrainian energy regulator is considering switching some thermal power plants to gas rather than coal this winter given low coal reserves. That said, strong power-sector gas burn could be at least partly offset by continued low industrial demand (see consumption graph).

If consumption is in line with the five-year average, keeping all other assumptions the same, stocks would be 13.8bn m³ at the start of next winter — 5.3bn m³ below the six-year average.

There would be much more scope for Ukrainian stocks to be built up if imports are made from Poland or Hungary. Ukrainian exit bookings to Poland for the 2022 calendar year currently stand at 3.8bn m³.