EU manufacturing output continued to drop on both the month and year in November, although the chemicals sector showed signs of recovery, according to preliminary data from Eurostat.

EU production as a whole fell to 107.9 points against a 100-point basis in 2015, slightly below 108 in October and the lowest for any month since September 2021. EU output fell by 6.3pc compared with November 2022, its seventh consecutive year-on-year reduction.

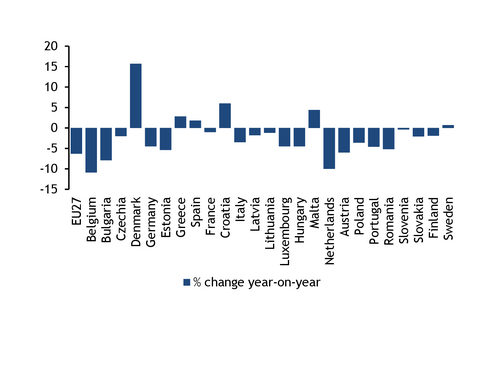

Production in the five top gas-consuming countries — Germany, the Netherlands, Spain, Italy and France — was mostly weak, with output only rising by 1.8pc in Spain and falling in the other four countries (see year-on-year graph).

The Netherlands continued its trend of poor performance, registering a 10pc decline on the year, an 11th consecutive month of decline.

Similar to the EU as a whole, November was also the weakest month for German manufacturing output since September 2021, coming in at just 93.2 points compared with a 2015 basis, down from 93.6 points in October.

Output in most key gas-intensive sectors across the EU was much lower than a year earlier. The non-metallic minerals and paper products sectors led the decline for a sixth consecutive month, falling by around 14pc and 5pc, respectively (see year-on-year sector table). Coke and refined products reversed two consecutive months of increases, falling by 0.6pc.

But the most gas-intensive industrial sector — chemicals — registered a year-on-year increase of 1pc, the first such increase since February 2022. Production in Germany, the largest chemicals producer in the bloc, was up by 1.5pc on the year, the first such growth since November 2021.

Motor vehicles manufacturing rose by 3pc on the year, continuing a trend of strong growth this year, although it was the lowest such increase in 2023, having reached a peak of 26pc growth on the year in February.

Monthly output marginally lower

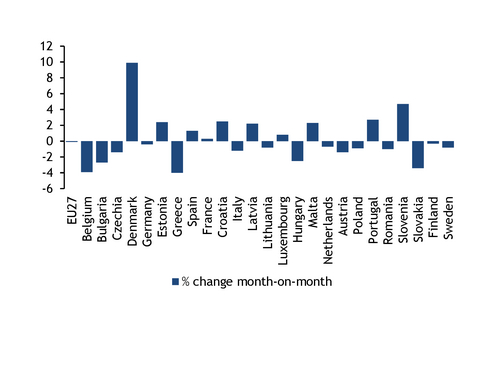

EU manufacturing also edged down by 0.1pc from October, the fourth monthly drop since June as production has weakened since the summer.

Production decreased on the month in Italy, Germany and the Netherlands, but was higher in Spain and France (see month-on-month graph). Danish production was particularly strong in November, up by roughly 16pc on the year and 10pc on the month.

Danish output has been higher on the month in most of 2023, but this was the largest such increase and brought Danish manufacturing at a basis to 2015 up to 168 points, the highest since Eurostat's records began. Denmark's previous high was 165.4 points in June.

Output in almost all gas-intensive EU sectors fell in November from October (see month-on-month sector table). But defying that general trend, chemicals registered a 1.6pc monthly increase, along with its 1pc rise on the year. German chemical manufacturing was up 5pc on the month.

EU inflation eased further to just over 3pc in November, Eurostat data show, the lowest since July 2021. But in its flash estimate for December, Eurostat expects euro area inflation to rise to 2.9pc from 2.4pc in November. Such an increase makes any cut in interest rates from the European Central Bank unlikely, as it has consistently said it is willing to keep interest rates high in order to get inflation below its target of 2pc.

Eurostat's economic sentiment indicator in December improved to 95.6 points from 93.8 in November, the highest since April, but still held below the long-term average basis of 100.

| EU year-on-year sector change | ±% |

| All manufacturing | -6.3 |

| Chemicals and chemical products | 1.0 |

| Non-metallic minerals | -14.0 |

| Food products and beverages | -3.0 |

| Paper and paper products | -5.4 |

| Basic metals | -4.7 |

| Coke and refined petroleum products | -0.6 |

| Motor vehicles and other transport | 3.3 |

| — Eurostat data calendar-adjusted but not seasonally | |

| EU month-on-month sector change | ±% |

| All manufacturing | -0.1 |

| Chemicals and chemical products | 1.6 |

| Non-metallic minerals | -0.8 |

| Food products and beverages | -0.3 |

| Paper and paper products | 1.6 |

| Basic metals | -0.9 |

| Coke and refined petroleum products | -0.4 |

| Motor vehicles and other transport | -0.8 |

| — Eurostat data seasonally and calendar-adjusted | |