Freer flowing transits at the Panama Canal have resulted in less surplus US supply arriving in Europe, tightening the spot market, write Efcharis Sgourou and Emma Reiss

A bearish northwest European propane market in the first half of this year has come to an end with regional sellers' confidence slowly returning as supply tightness and demand begins to pick up.

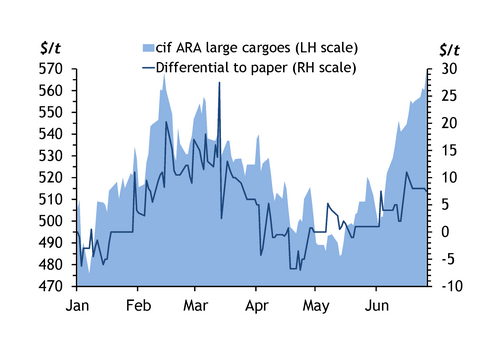

The propane large cargo cif Amsterdam-Rotterdam-Antwerp price moved minimally in January-June, with swings contained within a $100/t range despite crude gains owing to lukewarm demand and sufficient supply. The price fell to a low of $475.50/t on 8 January and hit a high of $569/t on 27 June — inversely to the typical seasonal pattern. Usual support from strong propane demand during the first quarter was largely absent after a mild winter, with record temperatures in January and February across Europe, capping heating use. Europe also benefited from shipping disruptions at the Panama Canal that forced US Gulf coast exports to reroute eastwards, freeing up more supply to sail the shorter distance to Europe.

The possibility to tap US supply even when northwest European prices were not competitive compared with Asia-Pacific built a sense of strong security for buyers. But demand remained weak, even from the petrochemical sector, where operating rates at ethylene crackers rose to around 80pc from historically low levels of 60-70pc during hostilities in the Red Sea in February that threatened Mideast Gulf petrochemical imports. This was well below typical run rates of 80-90pc.

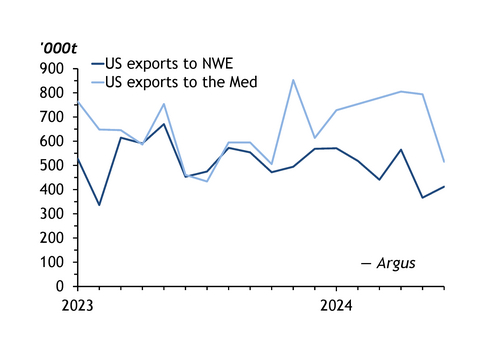

Northwest European LPG imports from the US nevertheless surged in the first quarter as US LPG production continued to expand. Arrivals from the country stood at 487,000 t/month over January-June, while regional availability also improved, with exports from North Sea producers averaging 450,000 t/month, Kpler datashow — regional output was supported by lower natural gas prices. Regional sellers became increasingly fearful of a surplus of US propane arriving in Europe, while end-users hoped for lower prices and were subsequently willing to wait for offers to decline, creating something of a standoff. Demand stagnated further in the second quarter as the US-northwest Europe arbitrage shut firmly and US deliveries dried up, with shipments to Europe dropping below 400,000t in May.

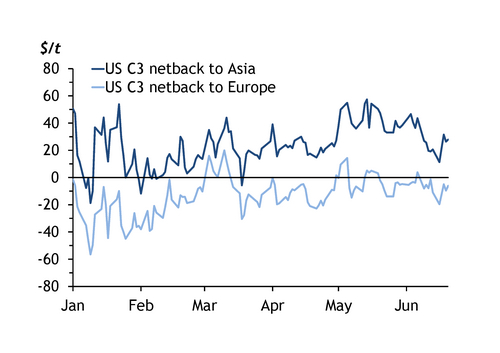

Shipping obstacles at the Panama Canal improved in the second quarter as its operator ACP increased the number of daily transits for July, reducing the likelihood of surplus US LPG coming to Europe this month. This has led to a tighter spot market and more bullish sentiment. Buyers are aware that demand in Asia, which dominates the attention of US sellers, is unlikely to slow after petrochemical demand recently picked up. The Chinese propane dehydrogenation sector continues to expand — three new plants opened in the first half of 2024 and four more are due to open in the second half, potentially lifting propane import demand by 6mn t/yr.

Premiums yet to pull US supply

European buyers will have to offer better netbacks compared with Asia to US sellers to attract supply. Physical large cargo prices are holding at robust premiums to paper, but have been insufficient to attract US tonnes. Simultaneously, the minimal premium for winter prices compared with summer makes stockbuilding ahead of winter financially painful, even without factoring in the premium for physical.

Regional availability will also play a part, with supply vulnerable to shifts in natural gas prices. For now, the natural gas value remains well below propane and recent highs, but forward curves point to the potential for local supplies to tighten as upstream product is spiked into the natural gas stream and refiners once again turn to using their LPG as fuel. On top of this, the ban on Russian exports to Europe from December will lead to greater demand from eastern Europe for western LPG. A return to more usual seasonal chills would mean Europe facing a potentially difficult winter, and physical premiums soaring as the region fights with Asia for the necessary US supply.