US thermal coal exports fell by 10.8pc on the year in April owing to weak thermal demand in Europe, US census data show.

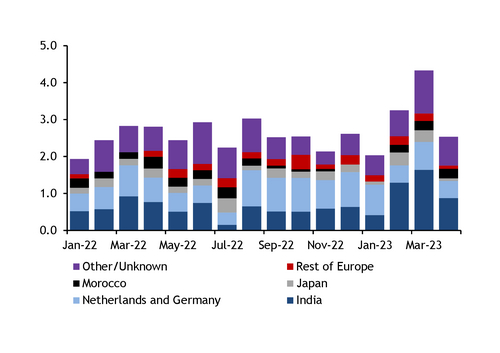

Exports to the EU-27 and the UK totalled 560,000t in April, down by 46.4pc from the 820,000t exported during the same period last year. Exports to the Netherlands and Germany — the main buyers in the region — totalled 470,000t in April, down by 28.8pc from 660,000t last year.

Shipments to Morocco also declined, despite Moroccan buyer's decision to diversify away from Russian supply owing to difficulties in processing payments. Moroccan shipments fell by 23.3pc on the year to 320,000t, and exports to Japan fell to nearly nothing, from 250,000t a year earlier.

Meanwhile, Indian demand for US supply firmed, with exports rising by 13pc, or 100,000, to 870,000t.

Exports to Egypt rose to 120,000t from nothing a year earlier and the Dominican Republic's intake of US coal more than doubled on the year, to 240,000t from 100,000t.

Some US thermal coal from Wyoming and Montana is railed to the Westshore coal terminal in Vancouver, Canada, and then exported to other destinations, a Canadian thermal coal exporter told Argus. Canadian coal rail traffic was flat on the year at 8,677 carloads in March, up by 1.4pc from 8,559 carloads last year, according to data from the Association of American Railroads.

Baltimore bucks lower export trend

Shipments from all key US exporting districts fell in April, with the exception of Baltimore. Exports from Baltimore rose by 25.4pc on the year to 1.2mn t, owing to strong Indian brick kiln demand for high calorific value (CV) North Appalachian (NAPP) coal.

Norfolk in the Hampton Roads led the decline, as shipments from the region were down by 25.6pc on the year to 242,000t in April. All other districts' exports fell by a combined 35.6pc on the year in April.

The three coal terminals in the Hampton Roads region of Virginia handled an estimated 2.46mn t during April, up from 2.3mn t in April 2022, the Virginia Maritime Association said. This may include some coking coal.

Exports to India from Baltimore rose by 18.5pc on the year to 870,0007t, from 710,000t a year earlier.

Exports to the Netherlands and Germany from Baltimore and Norfolk rose by 50.6pc on the year in April, to 130,000t. Exports to the same two countries from New Orleans and Mobile fell by 77.4pc to 330,000t, from 430,000t a year earlier. European buyers' appetite for high-sulphur coal is weakening as they have limited options to source coal with high CV and low-sulphur content in the aftermath of sanctions against Russian supply. This likely weighed on interest for Illinois basin coal in April, as interest in lower-sulphur materials such as NAPP and Central Appalachian coal is increasing.

European demand for US supply is expected to remain muted. There is "no demand" and it is very unlikely that any new business for US coal is being done, a European thermal coal trader said.

Exports to India firm despite lower coke prices

Petroleum coke prices have become more competitive recently, as availability has increased and demand has been subdued in key demand markets. This has prompted Indian cement producers to increase coke's share in their fuel mix at the expense of thermal coal.

India typically takes NAPP NAR 6,900 kcal/kg coal for its brick kiln and cement industries. Indian brick kilns increased production in February-June and demand is currently strong, a trader said. But consumption of US thermal coal in the cement industry is "definitely slower" because of lower coke prices, the trader added.

The delivered India price of 6.5pc sulphur coke was $3.62/mn Btu on 5 June, compared with $3.95/mn Btu for high-sulphur Illinois Basin coal and $4.76/mn Btu for delivered NAPP coal, according to Argus calculations.

In India, 6.5pc sulphur coke prices were at 77pc of NAR 6,000 kcal/kg coal on 7 June, compared with 84pc on 24 May and 97pc on 9 March. A year earlier, coke prices accounted for 59pc of coal prices.