Iran's recently appointed oil minister Mohsen Paknejad has set ambitious targets for his four-year term, among them serious upstream capacity gains for both crude oil and gas production. But the US sanctions that remain in place, and the possibility they might get even tougher should Republican Donald Trump win the US presidential election, will almost certainly complicate efforts to deliver.

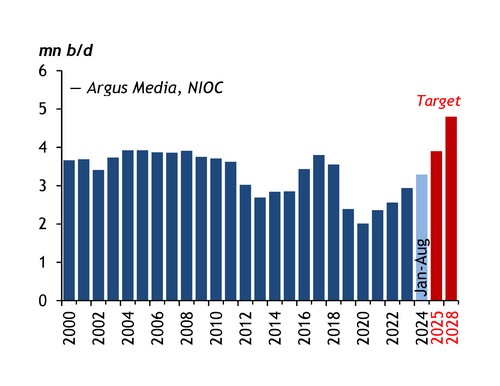

An oil industry veteran with close to 30 years of experience, Paknejad takes on his role in the new government of President Masoud Pezeshkian. He takes over the reins at a critical time for Iran as it continues to contend with stringent US-led sanctions reimposed in 2018, aimed at suffocating its key energy and banking industries, and its economy. But although the sanctions did initially force Iran's crude exports to below 500,000 b/d in the 12-18 months that followed from a pre-sanctions high of 2.3mn b/d, the last three years have seen a steady recovery. Exports — mainly to China, at discounts — are now holding well above 1.5mn b/d, and in some months reaching as high as 1.7mn b/d. This has in turn enabled a resurgence in Iran's crude oil output, which Argus estimates at 3.33mn b/d in August, up from below 2mn b/d in the second half of 2020.

Although Iran's crude oil exports are still some way below pre-sanctions levels, the recovery has put the country on much firmer ground as the new administration in Tehran gets its feet under the table. And Pezeshkian's government is looking to pick up where its predecessor left off, and press ahead with key strategic targets, with a clear focus on the upstream.

Paknejad has highlighted lifting Iran's crude output capacity as one of the two biggest challenges facing him and his teams at both the oil ministry and Iran's state-run oil company NIOC. With the revival in exports, Iran's crude production now stands at less than 500,000 b/d below the 3.81mn b/d it averaged in the first half of 2018, before the Trump administration re-imposed sanctions. Paknejad's predecessor Javad Owji said just three months ago that, despite the sanctions, crude output would continue to rise to reach 4mn b/d by March 2025, a level Iran has not come close to delivering in any sustained way since the second half of 2005.

Crude calculations

Paknejad acknowledged that Iran's crude capacity has been eroded to 3.4mn b/d as a result of the sanctions from close to 3.9mn b/d before, but he says the country is well placed to get at least very close to that 4mn b/d target, but by September next year, rather than March. Over the coming 12 months, he sees a series of upstream projects already under way by state-run operators at producing fields to recover 400,000 b/d of that lost capacity at a cost of around $3bn. This will be supplemented by close to 60,000 b/d of new capacity from fields in the West Karun cluster bordering Iraq, almost half of it from the giant Azadegan field. Those increments would raise capacity to close to 3.9mn b/d.

In the longer-term, Paknejad is targeting further additions that would take the country's crude capacity to around 4.8mn b/d, in line with the goals set out in Iran's latest five-year development plan covering 2023-28. These will be delivered through three separate packages, with the biggest additions coming at a number of Iran's giant workhorse fields, including Ab Teymour, Ahvaz, Mansouri, Marun and Gachsaran (see table).

Priority has also been given to the fields Iran shares with its neighbours, both onshore, with the likes of Iraq, and offshore in the Mideast Gulf, with the likes of Saudi Arabia, Kuwait and Qatar. With these capacity additions, Paknejad says he hopes to "re-establish Iran as the second-largest producer in Opec", but ongoing expansions in UAE and Iraq, the producer group's current second and third-largest producers, makes achieving that target unlikely.

Despite vast natural gas reserves — second in the world only to Russia — Iran has long played an undersized role in global gas markets as decades of heavy government subsidies have encouraged overconsumption and waste, and in turn left only small volumes available for export. Paknejad highlights controlling Iran's worsening gas balance as the other of his two biggest challenges. This would entail boosting domestic gas supply and enforcing initiatives to help manage domestic consumption. Iran's near 1bn m³/d of gas output today is "not enough to meet all of Iran's domestic and export requirements", the minister says, with the country facing shortages of more than 200mn m³/d at times of peak demand.

He sees gas output rising by 60mn m³/d within the coming 12 months, owing to additions from the supergiant offshore South Pars gas field that shares a reservoir with Qatar's North Field, specifically the completion of the long-delayed phase 11 that began producing in August 2023, as well as early production from several projects, including the Dey, Aghar and Khartang fields.

Gas outlook below par

But it is in the three years that follow that the ministry faces its most critical test — boosting reservoir pressure at South Pars, which Iranian officials have for years been warning will soon begin to fall if left unchecked. The field now produces 70-75pc of Iran's gas. "If we don't deal with this issue, we could be faced with falling gas and condensate production within three years," Paknejad says.

Iran in March awarded $20bn in contracts to four domestic upstream contractors to carry out the programme that NIOC said will ultimately result in the recovery of an additional 90 trillion ft³ (2.5 trillion m³) through the use of tens of 30MW compressors on 14 offshore platforms. Paknejad says his team aims to secure the financing needed from Iran's sovereign wealth fund, the NDF, by mid-October, and expects to have the first compressor up and running by March 2028.

The ministry is also looking to award contracts to develop a host of offshore and onshore giant greenfield gas projects over the coming years that would ultimately add around 480mn m³/d to Iran's output (see table). The plan is to raise Iran's gas production to 1.25bn m³/d by the end of this government's term in August 2028.

Iran's sanctions-hit upstream sector is in need of around $124bn in investment over the coming eight years, Paknejad says, with $72bn of this directed to oil projects and the remaining $52bn to gas projects. The minister says the lion's share of the funding will need to come from domestic sources, among them "financial markets and the NDF", and that it is "critical" $80bn of that investment is made within the first four years to deliver these key strategic goals.

Paknejad does not rule out some of this funding to come from foreign sources, but concedes that the reimposition of US sanctions, following Washington's decision to pull out of the 2015 Iran nuclear deal, has "resulted in serious challenges" to attracting foreign investment. Iran will almost certainly lean most heavily on the likes of its allies such as Russia and China to support its upstream ambitions, but experience shows that neither can be relied on to take on key energy projects in Iran while the US sanctions remain in place.

President Pezeshkian has made the removal of sanctions a key priority for his time in office. But although his selection of leading nuclear deal negotiator Abbas Araqchi as foreign minister does improve prospects for an easing of tensions with the US, the real possibility of Trump returning to the White House next year will loom large over Paknejad as he plans for the future.

| Planned oil capacity increases ('000 b/d) | |

| Field | Increment |

| Package 1 | |

| Yaran | 15 |

| Sohrab | 15 |

| South Pars oil layer | 17 |

| Aban, West Paydar | 5 |

| Sepehr and Jofeyr | 70 |

| Shadegan | 55 |

| Koupal | 30 |

| Cheshme Khosh, Dalpari, East Paydar | 50 |

| Total | 257 |

| Package 2 | |

| Azadegan | 175 |

| Changuleh | 30 |

| Azar | 21 |

| Band-e-Karkheh | 5 |

| Sumar, Salman, Delevaran | 9 |

| Masjed Soleiman | 9 |

| Total | 249 |

| Package 3 | |

| Yadavaran | 50 |

| Dehloran and Danan | 11 |

| Esfandiar | 4 |

| Bangestan, Ab Teymour, Mansouri, Ahvaz | 210 |

| Marun Asmari, Bangestan | 150 |

| Gachsaran | 80 |

| Bibi Hakimeh | 30 |

| Susangerd | 35 |

| Darkhovin | 20 |

| Abuzar | 15 |

| Total | 605 |

| Planned gas output increases (mn m3/d) | |

| Field | increment |

| Short-term | |

| South Pars various phases | 6 |

| South Pars phase 11 | 31 |

| Dey, Aghar, Khartang | 23 |

| Total | 60 |

| Long-term | |

| Package 1 | |

| North Pars | 100 |

| Kish | 85 |

| Golshan, Ferdows | 56 |

| Farzad A and B | 42 |

| Firouz B | 28 |

| Lavan | 15 |

| Total | 326 |

| Package 2 | |

| Sefid Zaghor | |

| Halegan | |

| Sefid Baghoun | |

| Gardan | |

| Khartang | |

| Eram | |

| Pazan | |

| Madar | |

| Aghar phase 2 | |

| Dey | |

| Toos | |

| Total | 130 |