The price premium of light crude to heavier grades may narrow in 2023, as demand for medium and heavy sour crudes rises following Asian refinery start-ups while supplies may tighten if Opec+ keeps cutting production.

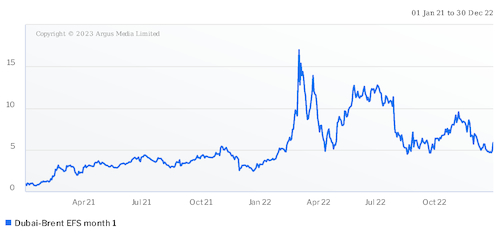

The Brent-Dubai exchange of futures for swaps (EFS) — the premium of light sweet Ice Brent crude futures to medium sour Mideast Gulf benchmark Dubai crude swaps, and a key indicator of the light-heavy crude spread — widened sharply in 2022 as the Russian-Ukraine conflict in February boosted Ice Brent futures. The front month Brent-Dubai EFS in 2022 averaged around $7.78/bl as of 30 December 2022, compared to an annual average EFS of $3.18/bl in 2021. The Brent-Dubai EFS in 2022 is set to be the widest on an annual average basis since Argus records began in 2003.

Refinery start-ups

But the Brent-Dubai EFS is likely to narrow in 2023 as refineries coming on stream in Asia-Pacific and the Mideast Gulf will run on a diet of predominantly medium and heavy sour crude, which could underpin Dubai prices.

Chinese private-sector Shenghong Petrochemical started trial runs at its 320,000 b/d Lianyungang refinery in east China's Jiangsu province from around 6 November and was running at around 60pc for the month. Shenghong may raise Lianyungang's operating rates to nameplate capacity after the lunar new year holiday ends in February 2023.

State-owned PetroChina is preparing to start up its new 400,000 b/d Jieyang refinery in Guangdong province, despite the dismal outlook for short-term oil demand. PetroChina started injecting crude into the refinery's crude units at the end of October. Kuwait's 615,000 b/d al-Zour refinery began operations in November 2022, a refinery built with the intention of running heavy Kuwaiti crude.

Potential supply cuts

Supplies of Mideast Gulf crude may also tighten in 2023 as the Opec+ consortium agreed in its last meeting in December to maintain its 2mn b/d quota cut.

Mideast Gulf producers comprise the bulk of the Opec+ group, and they usually prioritise cutting medium and heavy sour crude production as lighter crudes command a higher price. All eyes will be on the next meeting due in June 2023, with any further production cuts helping to boost benchmark Dubai prices, should producers choose to limit medium and heavy sour crude production.

Crude price outlook

Middle East crudes — which are mainly medium to heavy and have a high sulphur content — have been under pressure throughout 2022, dampening Dubai crude values.

The wide Brent-Dubai EFS can be largely attributed to the diversion of Russia's medium sour export Urals from Europe to Asia, as refiners in Europe and the US voluntarily cut back Urals crude imports in protest to the Russia-Ukraine conflict. Ice Brent crude was in turn supported as European refiners increased demand for sweet crude including US WTI. Added support to light crude prices came from strong refining margins and tight supplies of light crude, in part because of export restrictions affecting various Libyan streams.

Prices of light sour Mideast Gulf crudes also firmed relative to medium and heavy sour grades in 2022, because of strong refining margins for gasoil and jet-kerosine. The price premium of Saudi Arabia's light sour Arab Extra Light crude to Arab Medium and Arab Heavy in the monthly official prices surged in 2022 compared with 2021. The Arab Extra Light official formula price was around $3.25/bl above Arab Heavy on average in 2022, compared with around $1.22/bl in 2021 and $1.03/bl in 2020.

Hopes of recovering Chinese demand contributed to the volatility in oil prices in the fourth quarter of 2022, with China going back and forth on easing and finally abandoning its zero-Covid policy in early December.

If China demand resurges in 2023 as expected, the Brent-Dubai EFS should narrow as demand for Mideast Gulf crudes pick up again, traders said. But there remains uncertainty over global oil demand in the coming year amid concerns over a recession, which may have some impact on the Brent-Dubai spread.