Middle East monthly sulphur price announcements from major producers rose by $20-21/t in September, alongside rising Middle East spot fob prices.

Qatar's state-owned Muntajat raised the Qatar Sulphur Price (QSP) for September to $102/t fob Ras Laffan/Mesaieed from the August QSP of $82/t fob. Meanwhile, Kuwaiti state-owned KPC set September's Kuwait Sulphur Price at $103/t fob Kuwait, up from $82/t fob in August. UAE's Adnoc has yet to announce its September price adjustment, which is expected in the coming days.

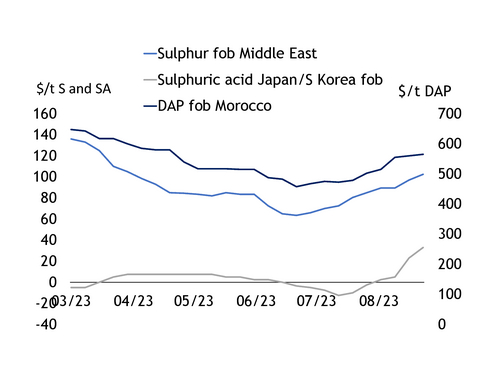

Sulphur fob spot prices bottomed out at the end of June, with monthly price announcements from the main Middle East suppliers at their lowest in July in a range of $63-68/t fob Middle East. Supplier spot prices have recovered by $39/t in the two months from end of June to the end of August, with the announced contract prices up by $34-40/t from June pricing to September-loading tonnes.

This recovery was aided by rising phosphate prices, after DAP fob Morocco spot prices also bottomed out at the end of June, rising steadily by $108/t from 29 June-31 August. Higher phosphate demand has supported operating rates, increasing raw material demand.

The same is evident for sulphuric acid prices, with fob Japan and South Korea beginning to lift a bit later from 20 July from negative levels, rising by as much as $46/t by the end of August.

The recovery in all these commodities followed a softening trend from the second quarter, with sulphur prices falling by $72/t from a 9 March peak of $136/t to the bottom reached in late June. September levels are still below those from early in the year.

September prices are still $30-33/t below those of the March peak of $133-136/t fob, and we are unlikely to see such levels again this year for sulphur prices, despite the current firming trend.