Pakistan's plans to move away from the seaborne thermal coal market will be a significant blow to the South African export market, forcing its coal sellers to be more competitive and potentially reducing overall export volumes.

Pakistan's imported coal demand is expected to hold at 9mn-10mn t/yr over the next two years, down from a peak of 18mn t in 2021 (see chart), customs data show. Of this approximate 9mn t demand contraction, about 7mn t will be South African coal, according to Argus calculations.

When demand from Pakistan initially retracted in 2022, South African sellers were able to pivot back to the European market, which was looking to replace sanctioned Russian coal, meaning the country's overall export volumes saw no real change, and in fact the record-high coal prices of the time resulted in large revenues for South African coal producers.

But with European demand relaxing and interest from Pakistan falling further, South Africa's sellers are now finding themselves with increasingly few outlets for their cargoes and a more competitive landscape may emerge.

Pakistan's other key source of coal, Indonesia, is usually a cheaper product in the market. As such, Pakistan's buyers shifted to these cheaper Indonesian tonnes where possible, so South African suppliers were disproportionately affected by the demand loss.

The grade commonly sold to Pakistan — roughly NAR 5,700 kcal/kg — is not widely consumed in larger markets such as India and China, where sellers typically look to place additional tonnes. Instead, buyers of this grade are usually in markets such as South Korea and Vietnam.

South Korea is already South Africa's second-largest export market, but it cannot absorb any significant volumes from South Africa given that sellers have to compete with Australian and Colombian coal, and overall demand is expected to stay at current levels before falling in the coming years.

South Korean buyers have cut back on Russian coal as a result of sanction fears, alleviating some pressure, but overall it is not a market that can take additional large volumes.

Vietnam could bridge gap

Vietnam is a source of growing coal demand, and South Africa exported 1.7mn t to this market last year, from 66,789t in 2019, when Vietnam first began buying South African coal, according to customs data. Vietnam's coal demand is anticipated to grow strongly in the coming years and its ministry earlier predicted coal demand of 60mn-100mn t/yr.

But unlike Pakistan, where South African coal had several advantages against other origins, Vietnam is more competitive, meaning sellers will either have to chase lower offers to keep market share or face a cutback in overall volumes.

South African export volumes already contracted in the years following the coronavirus pandemic because some mines had not reopened when Covid-19 restrictions were lifted, while national rail carrier Transnet continues to underperform on export rail deliveries. This means some of the lost volumes to Pakistan would not have even been produced, although even with lower export volumes, it remains difficult to place tonnes elsewhere in the market.

Pakistan shuns imported coal

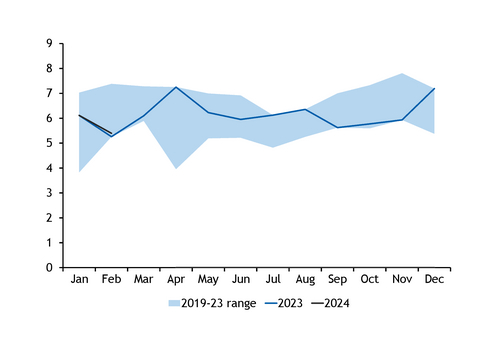

After India, which accounts for roughly 45pc of all South African coal exports, Pakistan was the second-largest destination for South African material, with overall import demand having grown to 18mn t by 2021, from 4.5mn t in 2016, on the back of newly constructed coal-fired power plants.

South African coal accounted for 60-70pc of Pakistan's imported volumes over this period, having supplied 12.3mn t in 2021. Pakistan typically purchased higher-calorific-value (higher-CV) coals from South Africa, ranging from NAR 5,500-6,000 kcal/kg, so it was also a profitable trade flow for South African exporters.

Given the average lifespan of coal-fired plants, Pakistan was seen as a steady source of long-term demand for the South African market, but a depletion of foreign exchange reserves when US dollar-denominated coal prices reached all-time highs in 2022, coupled with the political shift toward promoting Pakistan's domestic coal industry, has left seaborne demand hovering at levels last seen before any of the new coal-fired plants were commissioned.

Pakistan burned no imported coal for electricity generation in March, and the future for these coal-fired plants looks increasingly bleak as the government looks to convert its coal-fired plants to burn domestic coal exclusively.

Pakistan has imported only 1.9mnt of coal so far this year, according to Kpler data, bringing its full-year volume on an annualised basis to just over 5mn t.