An Aframax that loaded on Canada's Pacific coast has transferred its cargo onto a very large crude carrier (VLCC) at the Pacific Area Lightering zone (PAL) near southern California for delivery to China, marking the first ship-to-ship transfer of Canadian crude from the expanded Trans Mountain pipeline system.

The Unipec-controlled Aframax Sea Voyager loaded 450,000 bl of Cold Lake at the port of Vancouver's Westridge Marine Terminal on 1 June before transferring the cargo onto the VLCC Eagle Verona, also controlled by Unipec, on 9 June, according to ship tracking data from Vortexa.

The cargo was co-loaded with about 1.5mn bl of Colombian Castilla, which loaded onto the Eagle Verona at Puerto Armuelles on Panama's Pacific coast after it was shipped on the Trans-Panama Pipeline, according to Vortexa.

Canada's 590,000 b/d TMX project nearly tripled the capacity of Trans Mountain's system to 890,000 b/d when it opened on 1 May. The line creates a larger link from Alberta's growing oil sands production to the west coast port of Vancouver and direct access to lucrative Pacific Rim markets, where buyers are eager for heavy sour crude.

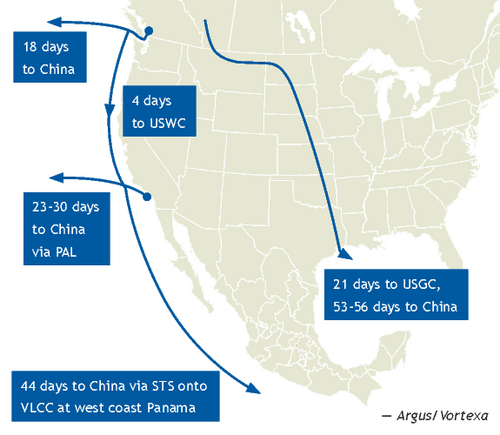

Westridge Marine Terminal cannot accommodate crude tankers larger than Aframaxes, cutting off the economies of scale offered at other ports by larger, 1mn bl Suezmaxes and 2mn bl VLCCs. But ship-to-ship transfers, or reverse lighterings, onto the larger vessels offer an alternative, with PAL the closest approved lightering zone for Vancouver.

Before TMX, ship-to-ship transfers of crude at PAL primarily were from VLCCs, loaded in the Mideast Gulf or Brazil, that discharged onto either Suezmaxes or Aframaxes for delivery to terminals in California and Washington state. Fuel oil cargoes from Latin America occasionally are transferred onto Suezmaxes at PAL for shipment to Asia-Pacific.

Favorable economics

The ship-to-ship transfer from the Sea Voyager to the Eagle Verona could mark the beginning of a new trade route for Canadian oil, with more favorable economics than a direct shipment from Vancouver to China.

Argus estimates that the cost on 13 June to reverse lighter, or transfer, three 550,000 bl shipments of Cold Lake from Vancouver onto a VLCC at PAL then onward to China was $7.16mn lumpsum, or $4.36/bl, including ship-to-ship transfer costs. This assumption excludes demurrage. In comparison, the cost to ship an Aframax-size cargo of crude from Vancouver directly to China was $3.45mn lumpsum, or $6.32/bl.

The price difference between the two modes of transporting crude from Vancouver to China can fluctuate depending on the market and vessel availability. For example, Argus estimates that the rate for a VLCC shipment from PAL to China fell to $2.9mn on 13 June from $4.05mn on 10 May amid a slowdown in the global VLCC market. Over that same span, the cost to ship an Aframax from Vancouver to the US west coast increased to $2.29/bl from $1.57/bl.

Of the 13 Aframaxes that have loaded TMX crude since 23 May, three either have gone or are heading directly to China. The remainder have transited or are transiting to ports on the US west coast, including at least two to PAL.

Another Aframax, the Shell-operated Advantage Award, transferred a 550,000 bl cargo of TMX crude onto the Shell-operated VLCC Advantage Value on 10 June, according to Vortexa data.

New marine pilot measures

Rising tanker traffic out of Vancouver in the wake of the TMX opening has also led to new safety measures, including using helicopters to shuttle marine pilots from outgoing crude-laden tankers, extending the area in which pilots are required to direct the ship, and extending the zone in which tankers must employ a tethered escort tug.

Prior to the TMX opening, which could bring about 30 more Aframax tankers to the region per month, pilots transferred to and from outgoing laden tankers only by boat. But under the new requirements by the Pacific Pilotage Authority, which oversees all west coast Canada marine pilot operations, helicopters will ferry pilots from departing tankers to dropoff points in the city of Victoria and nearby Vancouver.

Outgoing crude-laden tankers will also be required to have a pilot on the ship longer, having them depart at a point called Race Rocks instead of Brotchie Ledge, near Victoria. As before TMX, pilots will continue to board incoming tankers at Brotchie Ledge.

The extended zone moves the ships away from a comparatively busier area in the designated shipping lanes in the Strait of Juan de Fuca, where marine traffic converges en route to and from various ports in British Columbia and Washington state, the Pacific Pilotage Authority said.

By Tray Swanson