South Korea's automotive output, domestic sales and exports rose in February compared with a year earlier, with the country closely monitoring potential US trade measures.

The country's auto output rose by 17pc on the year to almost 352,000 units in February, according to South Korea's trade and industry ministry (Motie). Domestic sales rose by 15pc on the year to around 133,000 units, supported by a 30pc reduction on individual consumption tax on passenger cars until the first half of 2025, which has been capped at 1mn Korean won ($690).

Exports rose by 17pc on the year to almost 233,000 units, with auto export revenue hitting an all-time high for the month of February at $6.07bn.

Motie is planning to collect the automobile industry's opinions on the possibility of US trade measures, and will continue to closely monitor the potential impact and prepare "prompt" response measures, it said on 18 March.

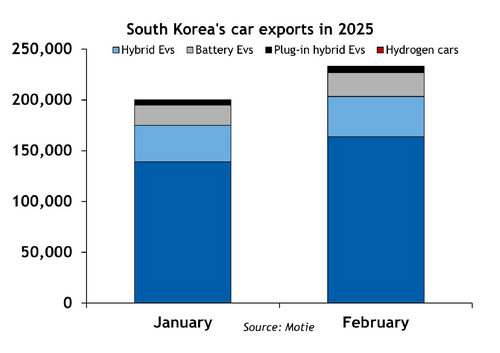

Eco-friendly vehicle domestic sales rose sharply by 50pc on the year to about 60,350 units in February, while exports rose by 32pc to almost 69,000 units. Eco-friendly vehicles in South Korea refers to hybrids, battery electric vehicles (BEVs), plug-in hybrids and hydrogen-fuelled vehicles.

Hybrid domestic sales were up by 25pc on the year to about 44,600 units, while BEV domestic sales almost quadrupled to about 14,300 units, which Motie attributed to the EV subsidies it introduced in January. The January support measures included additional 20pc subsidies for young South Koreans' first EV and highway toll fees exemptions for EV owners until 2027.

But BEV exports in February dipped by 2pc on the year to about 23,150 units, while hybrid exports continued to rise by almost 62pc to about 39,500 units.