Total Brazilian electric vehicle (EVs) sales were up in the first quarter, driven by increasing demand for hybrid vehicles (HEVs) as sales of battery electric vehicles (BEVs) tumbled.

Overall EV sales in Brazil grew by almost 40pc in the first three months of the year to 50,074 units, led by HEVs — including plug-ins (PHEVs), non-plug-ins, and mild hybrids (MHEVs) — which saw a 70.5pc surge compared to the same period in 2024, according to Fenabrave, a private body that represents car dealerships in Brazil. EVs made up 12.5pc of the total Brazilian car market, a three percentage point increase year-on-year.

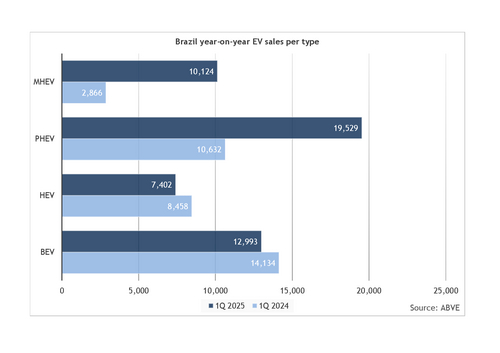

PHEVs were the most popular choice for consumers seeking an EV, with 19,530 units sold on the first quarter, up 83.6pc from last year, according to data from the Brazilian electric vehicles' association (ABVE).

BEVs accounted for 12,993 units sold, while MHEVs — vehicles with regular engines aided by small batteries that increase fuel efficiency but do not power the wheels — accounted for 10,724 units sold. A total of 7,402 non-plug-in HEVs were sold in the quarter.

Although HEV sales rose, BEVs tumbled 8.3pc due to general consumer skepticism about the Brazilian charging infrastructure and increasing popularity of PHEVs because of its above-average fuel efficiency and the possibility of driving on regular fuels, such as gasoline and ethanol.

BYD increases market dominance

BYD, a Chinese carmaker, further increased its EV market share in Brazil in the first quarter on aggressive discounts for its HEVs.

The Chinese brand, which only sells plug-ins and BEVs, offered discounts of over R20,000 ($3,400) per car plus other benefits in excess of R10,000 ($1,700) for their PHEVs. BYD sold around 11,710 PHEV units, more than double from the same period in 2024, and accounted for 31.4pc of the total HEV market in the first quarter, according to Fenabrave.

Fiat, which debuted in the EV segment in November and only markets MHEVs, sold 7,400 units, taking second place with a 19.8pc market share in January-March.

Great Wall Motors (GWM), another Chinese automaker, closed out the top three with 5,880 units in the period, holding 15.8pc market share.

PHEVs are becoming increasingly popular in Brazil even in regions with a solid charging infrastructure, according to ABVE. Major cities such as Sao Paulo and Brasilia — the country's capital — were among the top plug-in buyers due to the possibility of daily driving in electric mode and travelling long ranges on hybrid. BYD's plug-ins can drive for 745 miles on a single tank of gas, on a fully charged battery and loaded tank.

All types of EVs in Brazil are eligible for a yearly tax exemption of up to 4pc of the car's value in most states.

Although BEV sales were down, BYD still managed to increase its dominant place in the market. The Chinese automaker sold 9,680 EVs in the first three months of the year, more than 75pc of the nearly 12,880 units sold in the period. According to the company, 7 out of 10 BEVs sold in Brazil are from BYD. Volvo followed with almost 1,200 sold EVs and GWM had the third-highest sales figures at just 814.

Overall, BYD owns 42.7pc of the total Brazilian EV market, followed by Fiat at 14.8pc and GWM, with a 13.4pc market share. The two Chinese brands both plan to start manufacturing cars in Brazil by year's end. BYD also acquired mining rights for two separate lithium sites in the country in an effort to streamline its whole operation in the country, as it figures as its largest market outside of China.

| Brazil EV sales | units | |||

| Brand | 1Q 2025 | 1Q 2024 | ±% | Market share (%) |

| Total EVs (BEVs, HEVs) | ||||

| BYD | 21,384 | 14,920 | 43.3 | 42.7 |

| Fiat | 7,400 | n/a | n/a | 14.8 |

| GWM | 6,693 | 5,735 | 16.7 | 13.4 |

| Toyota | 4,277 | 5,049 | -16.2 | 8.5 |

| Volvo | 2,097 | 1,606 | 30.5 | 4.2 |

| Mercedes Benz | 1,765 | 1,166 | 51.3 | 3.5 |

| Honda | 1,207 | 567 | 112.8 | 2.4 |

| Caoa Chery | 1,203 | 2,105 | -42.8 | 2.4 |

| BMW | 911 | 825 | 10.4 | 1.8 |

| Porsche | 687 | 41 | 1,575.6 | 1.4 |

| Total (hybrid vehicles, EVs) | 50,074 | 35,872 | 39.6 | 100 |

| Electric vehicles (BEVs) | ||||

| BYD | 9,678 | 10,052 | -4 | 75.1 |

| Volvo | 1,196 | 596 | 101 | 9.2 |

| GWM | 814 | 1,892 | -57 | 6.3 |

| BMW | 219 | 238 | -8 | 1.7 |

| Renault | 176 | 187 | -6 | 1.3 |

| Porsche | 155 | 41 | 278.0 | 1.2 |

| Zeekr | 141 | n/a | n/a | 1.0 |

| Mini | 124 | 34 | 265 | 1.0 |

| JAC | 107 | 457 | 77 | 0.8 |

| Mercedes Benz | 38 | 39 | -3 | 0.3 |

| Total (EVs) | 12,877 | 14,053 | -8 | 100 |

| Hybrid vehicles (HEVs, PHEVs, MHEVs) | ||||

| BYD | 11,706 | 4,868 | 140.4 | 31.4 |

| Fiat | 7,400 | n/a | n/a | 19.9 |

| GWM | 5,879 | 3,843 | 52.9 | 15.8 |

| Toyota | 4,277 | 5,049 | -15.2 | 11.5 |

| Mercedes Benz | 1,727 | 1,127 | 53.2 | 4.6 |

| Honda | 1,207 | 567 | 112.8 | 3.2 |

| Caoa Chery | 1,203 | 2,105 | -42.8 | 3.2 |

| Volvo | 901 | 1,010 | -10.7 | 2.4 |

| BMW | 692 | 587 | 17.8 | 1.9 |

| Jaguar Land Rover | 627 | 816 | -23.1 | 1.7 |

| Total (hybrid vehicles) | 37,197 | 21,819 | 70.5 | 100 |

| Does not include all brands sold | ||||

| Source: Fenabrave | ||||